MYSCORE

A new dawn for the academic world

Since quality education requires a standard to measure how effective an education is in order to set students up for success in the rest of their lives,

we crafted MYSCORE to drive performance

at all levels

The Core Foundation

because we value a culture of high expectations and student engagement.

An easier, more intelligent platform to manage and enhance teaching and learning in your organisation

Simple to use, powerful at scale, and proven to produce better outcomes for learners.

Intuitive User Interface

Complete customization

Seamless integrations

Built with users

Awards

Mauritius Research Innovation Council

INTELLIGENT PLATFORM FOR ONLINE LEARNING (2023)

Mauritius Institute of Education

STEAM Competion 2023

Institutions

Open University of Mauritius

Keats College

Friendship College

Universal College

City College

Labourdonnais College

We work with

97% PASS RATE

12k Users onboarded

300k results published

500k inbox messages

Get Started.

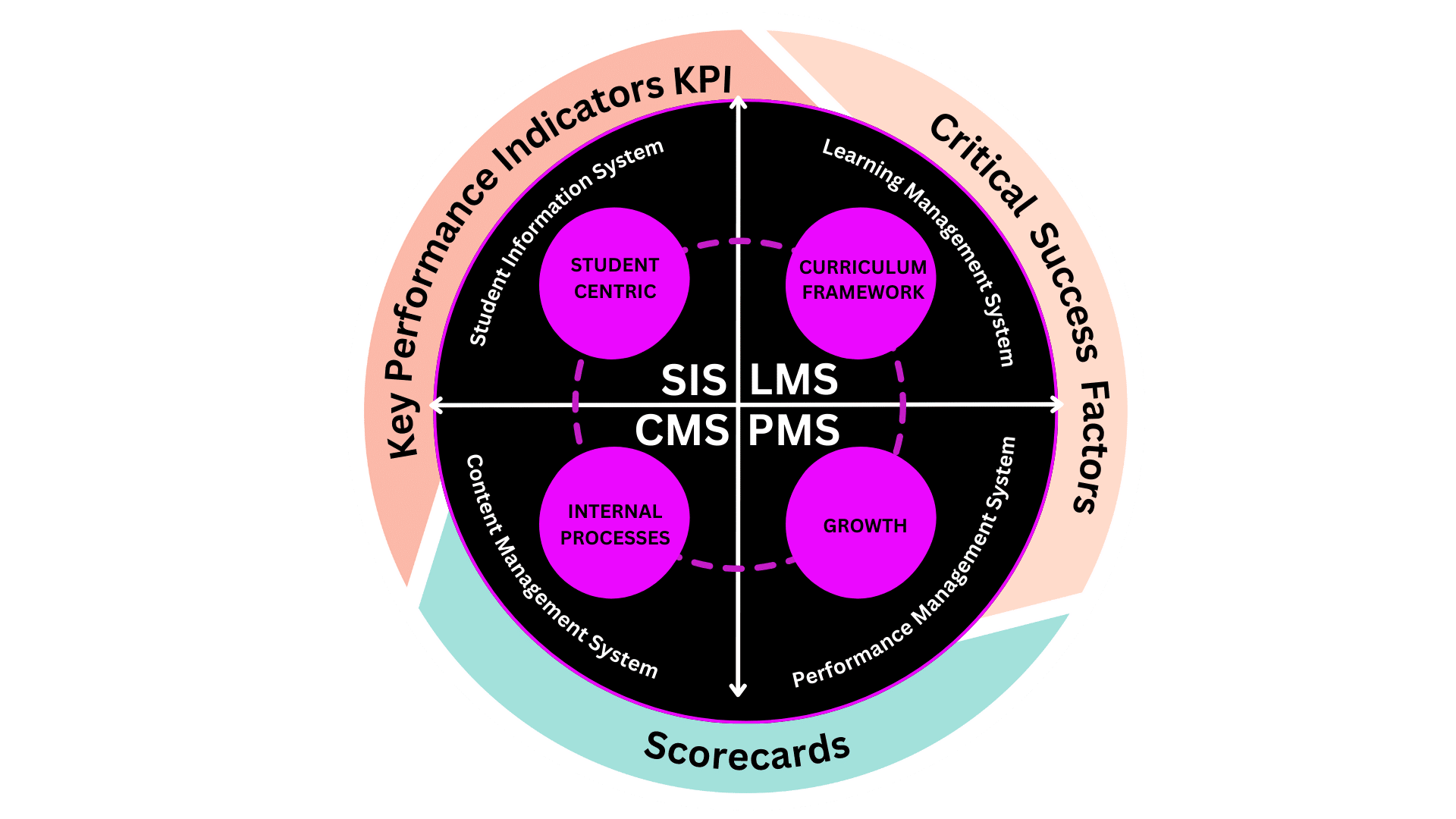

Internal Processes

Student Information System

Learning Management System

Platform

About

Terms

Privacy Policy

RESTIT LTEE

ENDEMIKA BUSINESS PARK.

(230) 5253-6444

Copyright © 2026 MYSCORE. All Rights Reserved.